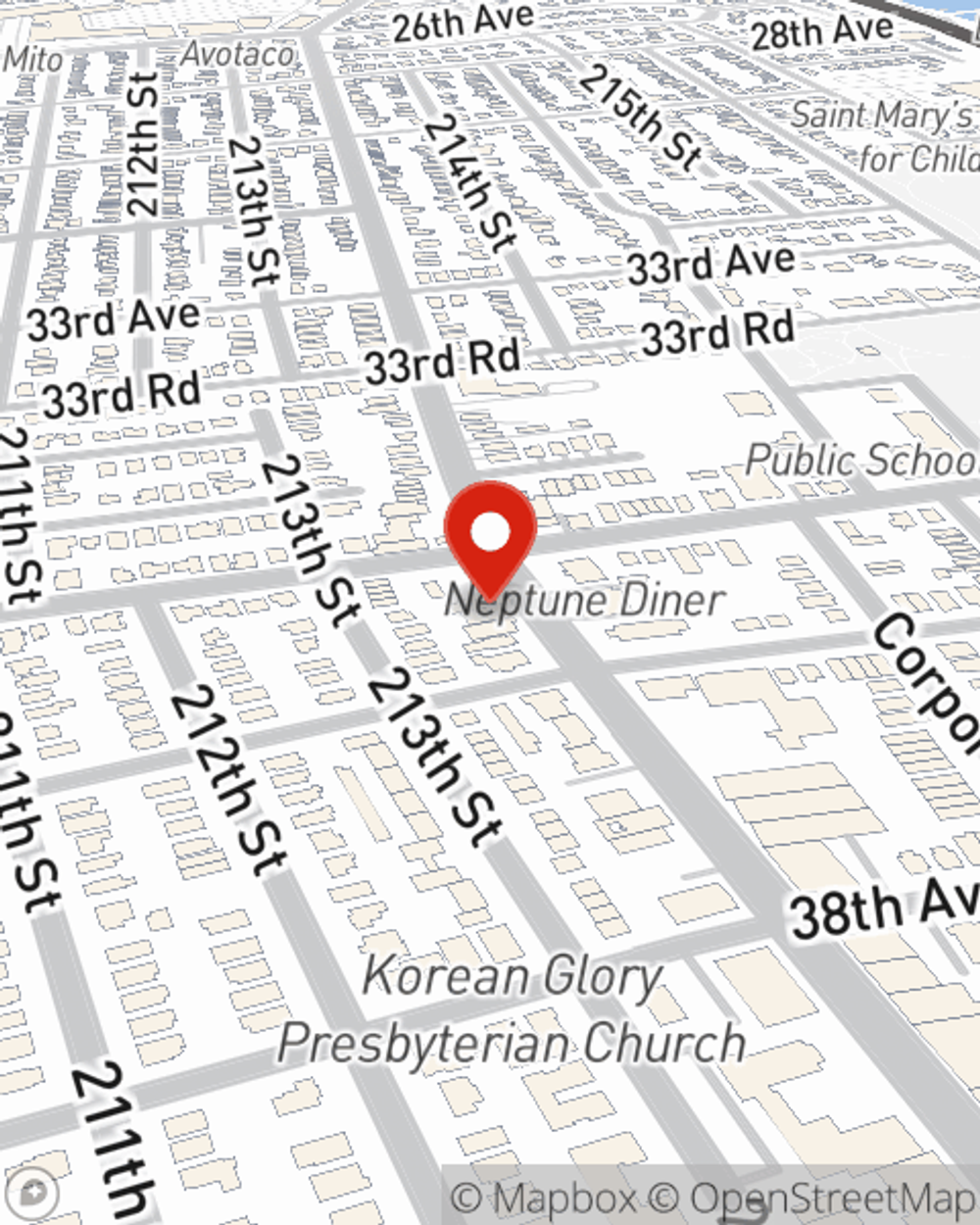

Life Insurance in and around BAYSIDE

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Taking care of those you love is a big deal. You help them make decisions advise them on important decisions, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Insurance that helps life's moments move on

Life won't wait. Neither should you.

Bayside Chooses Life Insurance From State Farm

Fortunately, State Farm offers many coverage options that can be modified to correspond with the needs of your loved ones and their unique situation. Agent Edward Min has the deep commitment and service you're looking for to help you select a policy which can help your loved ones in the wake of loss.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to check out what a company that processes nearly forty thousand claims each day can do for you? Reach out to State Farm Agent Edward Min today.

Have More Questions About Life Insurance?

Call Edward at (718) 229-2886 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.